What do you do with my tax information?Updated a year ago

We validate the data you input in our digital form against the details provided on the completed state-specified/resale form you submit. We then proceed to communicate with your state authority to confirm the active and legitimate status of your exemption. We store and maintain the information for future purchases as well as state reporting obligations. All data is kept strictly confidential and will never be disclosed, unless mandated by law to taxing or governmental authorities. The tax exemption details provided are specifically for customers based in the United States.

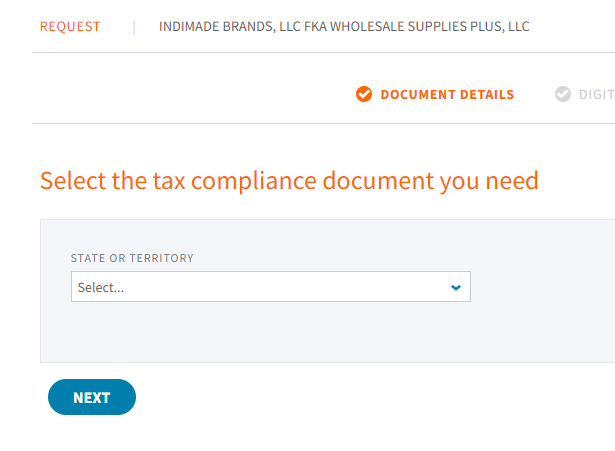

Select the state in which you are requesting sales tax exemption.

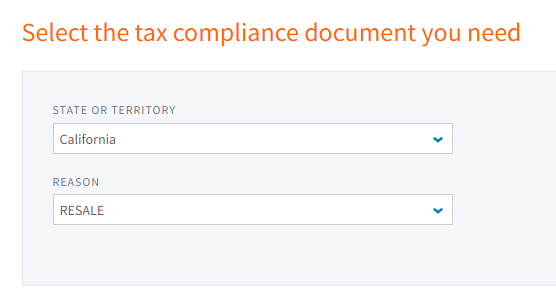

Select the reason for exemption. The majority will select RESALE or INDUSTRIAL PROD/MANUFACTURERS

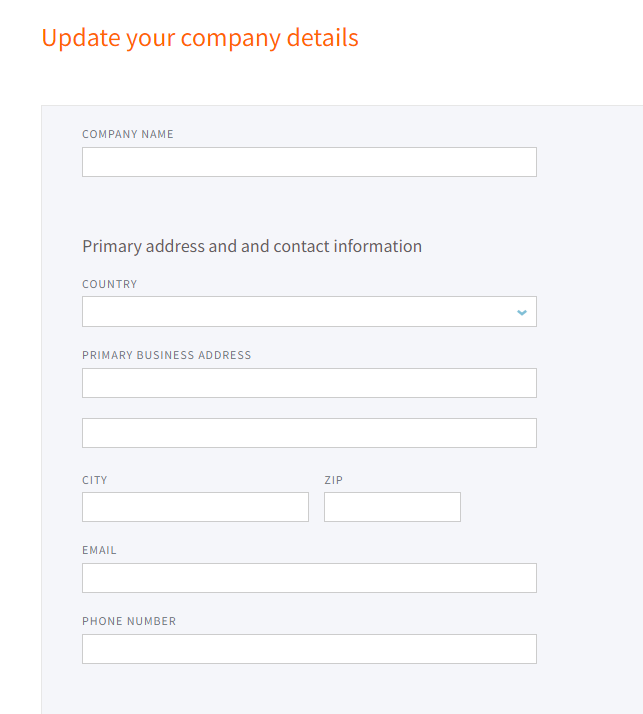

Fill in the name/company name and address associated with your state taxing authority permit/license.

Fill in the email address and phone number associated with your account with us.

***Note: if your name, company name, email address, or physical address on your account does not match what is in your tax exemption submission, this may delay your approval.***

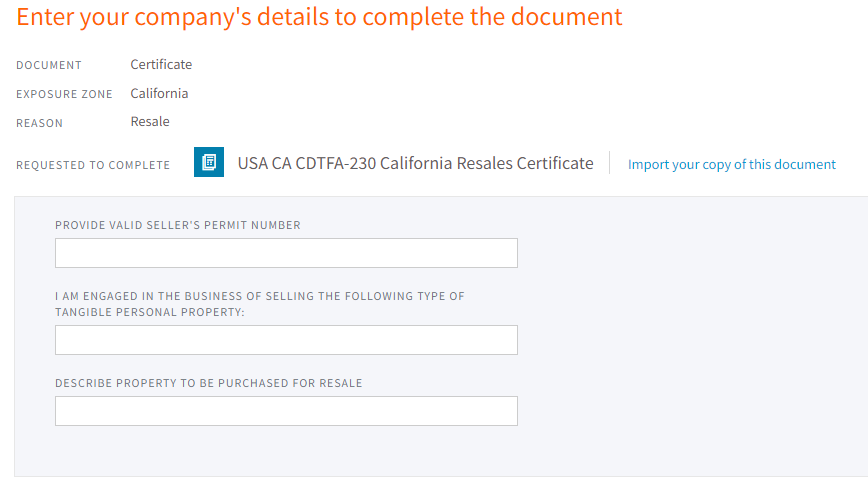

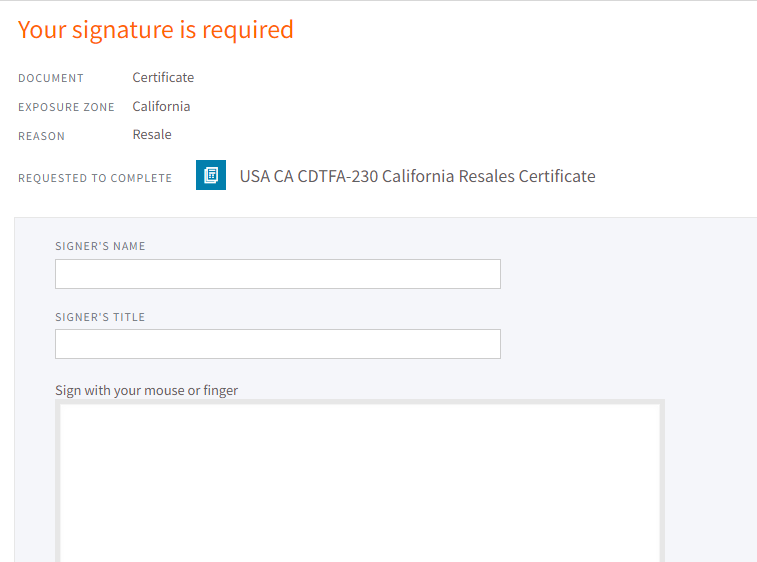

This screen may look different depending on your state. Fill in all boxes. The permit number/license/certificate should match your state-issued number. If your federal EIN is needed, the box will indicate this.

To ensure we have the proper documentation, you may import a copy of your state-issued tax exemption certificate/resale license/permit.

Sign using your name and title.

If you need to add another state for exemption, click the + box and proceed through the directions again using the additional state information. Otherwise, you are done unless we contact you for more information.